BRIEF OF ATAL PENSION YOJANA

• The Government of India is concerned about the old age income security of the working poor and is focused on encouraging and enabling them to save for their retirement. To address the longevity risks among the workers in unorganized sector and to encourage the workers in unorganized sector to voluntarily save for their retirement.

• The GoI has therefore announced a new scheme called Atal Pension Yojana (APY) in 2015-16 budget.

• The scheme is administered by the Pension Fund Regulatory and Development Authority (PFRDA) through NPS architecture.

HIGHLIGHTS OF ATAL PENSION YOJANA -

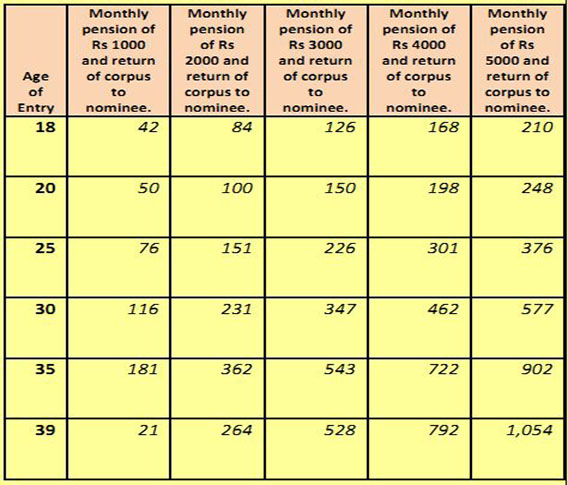

• Under the APY, there is minimum guaranteed monthly pension for the subscribers ranging from Rs. 1000, Rs 2000, Rs 3000, Rs 4000 and Rs. 5000 per month.

• The benefit of minimum monthly pension would be guaranteed by the GoI.

• GoI will also co-contribute 50% of the subscriber’s contribution or Rs. 1000 per annum, whichever is lower. Government co-contribution is available for those who are not covered under any Statutory Social Security Schemes and for not income tax payers. Government contribution will be credited through in subscriber’s Savings Bank account on yearly basis.

• GoI will co-contribute to each eligible subscriber , for a period of 5 years who joins the scheme between 1st June, 2015 to 31st December, 2015.

• The benefit of five years of government Co-contribution under APY would not exceed 5 years for all subscribers including migrated Swavalamban beneficiaries.

• All bank account holders may join APY.

Eligibility -

• APY is applicable to all citizen of India aged between 18-40 years.

• Aadhar and mobile number are recommended to be obtained subscriber for ease of operation of the scheme.If the same is not available at the time of registration, it may also be submitted at later stage.

Overdue Interest/Charges -

Under APY, the individual subscribers shall have an option to make the contribution on a monthly, quarterly, half yearly basis. Banks are required to collect additional amount for delayed payments. The overdue interest for delayed contributions would be as shown below :-

• Overdue interest for delayed contribution Rs. 1 per month for contribution for every Rs. 100, or part thereof, for each delayed monthly payment.

• Overdue interest for delayed contribution for quarterly/half yearly mode of contribution shall be recovered accordingly. The overdue interest will remain as part of the pension corpus of the subscriber.

Default in Contribution -

• Once the account balance in the subscriber’s account becomes zero due to deduction of account maintenance charges and fees, the account would be closed immediately.

• Subscriber should ensure that the Bank account is sufficiently funded to facilitate auto debit of contribution amount.

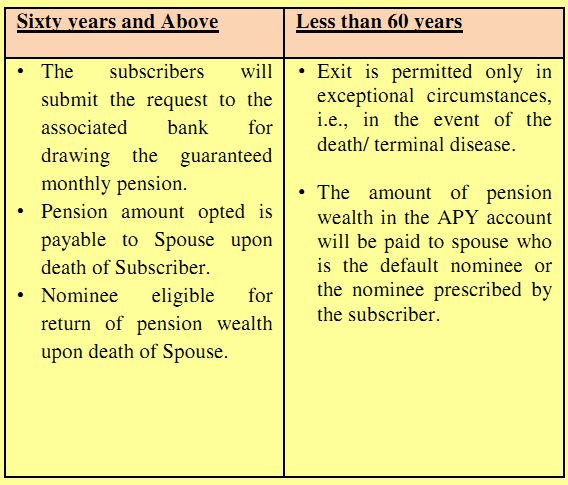

Exit -

Monthly Contribution Chart -